Ehsaas Naujawan Loan Program 2025

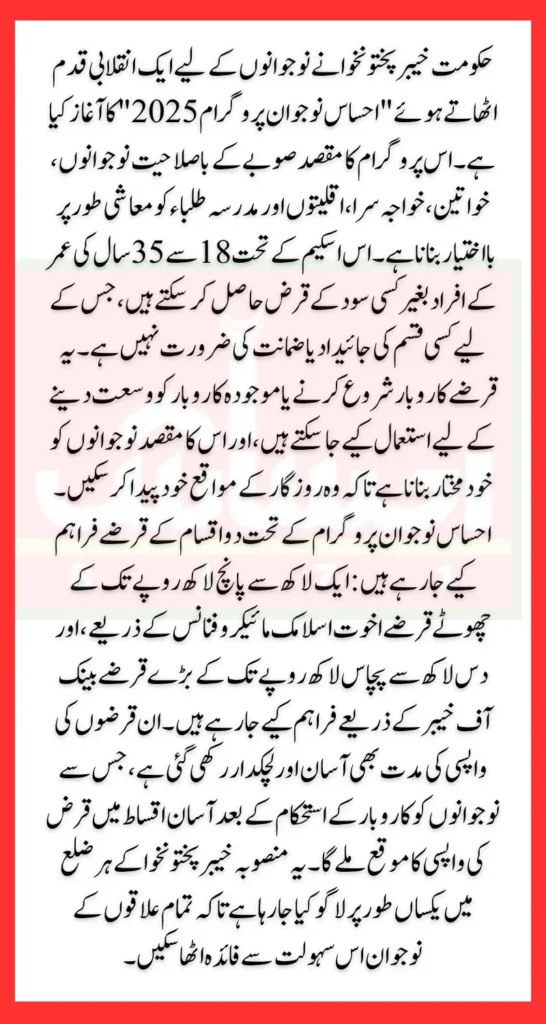

Ehsaas Naujawan Loan Program 2025 Government of Khyber Pakhtunkhwa has taken a remarkable initiative by launching the Ehsaas Naujawan Loan Program 2025 a youth-centered, interest-free loan scheme focused on uplifting young men, women, transgender individuals, madrasa students, and minority youth. With the active collaboration of the Directorate of Youth Affairs, Bank of Khyber, and Akhuwat Islamic Microfinance this program aims to promote self-employment, financial independence, and entrepreneurship across the province.

Thousands of talented and educated youth across KPK struggle daily with unemployment or lack of capital for their startup ideas. The Ehsaas Naujawan Program offers a lifeline by providing them with the financial means to start or grow businesses without the stress of interest or collateral. This program is not just about distributing loans it’s a mission to build a prosperous and self-reliant generation of young Pakistanis who can drive real economic change.

احساس نوجوان کے تحت، بینک آف خیبر 18 سے 35 سال کی عمر کے نوجوانوں کو، جن میں مدارس کے طلباء، اقلیتی برادریوں اور ٹرانس جینڈر افراد شامل ہیں، پانچ ملین روپے تک کے بلاسود قرضے فراہم کر رہا ہے۔

You Can Also Read: CM Rashan Card 2025 Registration Through PSER Survey

Who Can Benefit from the Ehsaas Naujawan Program?

| Feature | Details |

| Loan Type | Interest-Free No Markup |

| Eligibility | Youth 18–35 Transgender, Minorities, Madrasa Students |

| Small Loans (Akhuwat) | PKR 100,000 – 500,000 |

| Large Loans (Bank of Khyber) | PKR 1 million – 5 million |

| Collateral Required | No |

| Repayment Period | 3 to 8 Years Depending on loan type |

| Application Portal | ehsaasnaujawan.bok.com.pk |

| Support Helpline | 091-111-265-265 |

One of the strongest features of this program is its inclusiveness. The government has ensured that youth from all segments of society have an equal chance to access these resources and grow.

Eligibility Criteria:

- Permanent resident of Khyber Pakhtunkhwa, including Merged Districts

- Age between 18 to 35 years

- Must hold a valid CNIC

- Must have a clear and feasible business idea or plan

- Business must be located in KPK

- Females, transgender madrasa students, and minorities are strongly encouraged

- Graduates or skilled individuals with a viable plan

- Applicants with a clean e-CIB record loan repayment history

This program is designed for those who often face hurdles in securing financing from commercial banks due to lack of assets or formal education. No higher degree or prior business experience is required — only a valid CNIC and a business idea.

Ineligibility Who Cannot Apply?

Some individuals are not eligible for this scheme. These include:

- People applying in individual capacity must be part of a registered group or firm

- Government, semi-government, or autonomous body employees

- Loan defaulters with overdue payments over 60 days

- Employees of Bank of Khyber or any third-party consultants in the scheme

- Businesses dealing with arms, alcohol, explosives, or radioactive material

You Can Also Read: BISP Payment Distribution Date Announced

Loan Categories and Financing Options

The government understands that different businesses require different levels of investment. That’s why this program offers two distinct loan categories:

Small Business Loans Akhuwat Islamic Microfinance

For individuals looking to start micro or home-based businesses:

- Loan Amount: PKR 100,000 to PKR 500,000

- Interest Rate: 0% interest-free

- Repayment: 36 to 60 months

- Collateral: Not required

Large Business Loans Bank of Khyber

For youth who wish to establish medium or large-scale businesses:

- Loan Amount PKR 1 million to PKR 5 million

- Interest Rate 0% interest-free

- Repayment Period: Up to 8 years

- Collateral Not required

By offering both small and large loan options, the program ensures flexibility and wide applicability, making it ideal for everything from a retail shop to a tech startup or agricultural project.

You Can Also Read: Punjab Farmers Wheat Subsidy For Farmers 5000

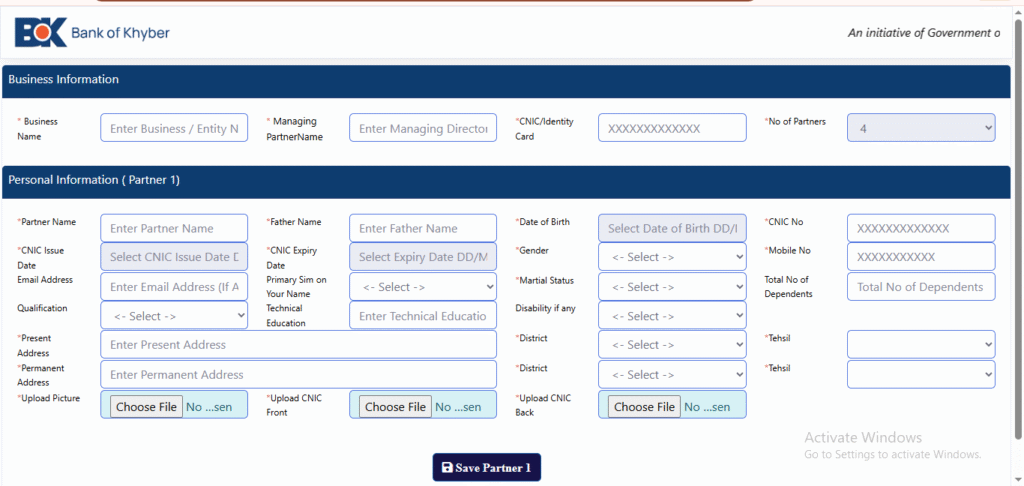

How to Apply Step-by-Step Application Process

The government has simplified the application process, making it easy and user-friendly, especially for first-time entrepreneurs.

For Bank of Khyber Loans PKR 1M to 5M

- Visit the official portal: https://ehsaasnaujawan.bok.com.pk

- Fill out the online application form

- Attach your CNIC and business plan or proposal

- Submit your application for processing

For Akhuwat Microfinance Loans PKR 100K to 500K

- Locate your nearest Akhuwat branch

- Visit in person with your CNIC and business idea

- Submit your application and supporting documents

- Wait for confirmation and disbursement

Applicants from all districts of Khyber Pakhtunkhwa are eligible. The loan distribution has been fairly allocated according to district population to ensure equal opportunities for youth across the province.

Repayment Plans with No Hidden Charges

Unlike commercial loans that come with high-interest rates, penalties, and property guarantees, this program is 100% interest-free and built around flexibility.

- Bank of Khyber Loans: Up to 8 years repayment time

- Akhuwat Loans 36 to 60 months repayment period

- No property collateral required

- No processing fee or interest

This structure relieves young entrepreneurs from the burden of financial pressure giving them time to establish and stabilize their businesses.

احساس نوجوان پروگرام میں جو قرض لیا جائے گا وہ بالکل بلا سود ہوگا اس پروگرام میں 36 ماہ تک قرض واپس کر سکتے ہیں اس میں کوئی بھی ہڈن چارجز نہیں رکھے گئے ہیں جو بھی معلومات ہوگی وہ اپ کے سامنے ہوگی

Major Benefits of the Ehsaas Naujawan Program

This initiative offers a wide range of benefits beyond just financing. It is a full-fledged support system designed to nurture the entrepreneurial ecosystem in the province.

- Empowers youth to become self-employed

- Promotes inclusive financial access to transgender and minority youth

- No-interest loans without collateral

- Loans available for all business types retail, tech, services, manufacturing, etc.

- Encourages economic development at the local level

- Equitable distribution of funds across all KPK districts

- Government-backed guarantee, making it secure and trustworthy

You Can Also Read: BISP 8171 Result Check Online By CNIC Know Details 13500

Contact Details and Support

If you need help or have questions, you can reach out through the following:

- Bank of Khyber Helpline: 091-111-265-265

- Official Bank of Khyber Website: www.bok.com.pk

- Ehsaas Naujawan Application Portal: https://ehsaasnaujawan.bok.com.pk

- Akhuwat Branch Network: https://akhuwat.org.pk/branch-network

Final Thoughts

The Ehsaas Naujawan Loan Program 2025 is more than just financial assistance it is a new beginning for thousands of youth across Khyber Pakhtunkhwa. With its zero-interest model, inclusive approach, and government-backed support, this scheme is expected to pave the way for economic independence, entrepreneurship, and self-sufficiency. Whether you dream of opening a shop, launching a startup, or expanding a family business, this program is your opportunity to make it happen with dignity and support

You Can Also Read: BISP 2025 Payment Offline Check Using CNIC 8171